Standard & Poor’s just released an updated forecast of $74.55 of operating earnings for the benchmark S&P 500 in 2010. How bullish is that? Well, 2006 saw the all-time high for operating earnings at $87.72. So, even though frugality is now in vogue, the saving rate is rising and credit is difficult to come by, S&P would have us believe that operations at the 500 largest public companies will be just 15% under all-time record levels next year! This forecast is laughable, yet many people believe it.

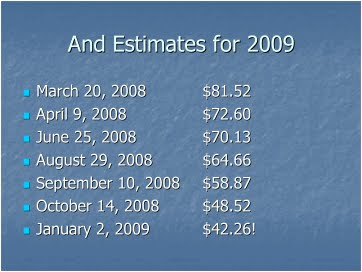

To assign the correct weight to S&P's current forecast, let's take a quick look at its analysts' record in predicting the 2008-2009 earnings collapse. Back in March 2007, S&P’s analysts’ estimate for 2008 was $92; the actual figure came in at $49.51, meaning that their estimate was 46% too high! In March 2008, with the recession already underway, their estimate for 2009 was $81.52. But, with half the year complete, that estimate has now been decreased to $55.25. Those facts don’t lend much credibility to their 2010 estimate. As the tables reveal, their estimates simply followed equity prices down. (Tables from: "Thoughts From the Frontline" by John Mauldin).

MyView

S&P forecast in operating earnings

Jan 08 for 2008 = 92 whereas actual = 48

Jan 09 for 2009 = 82 whereas actual = 42

Sep 09 for 2010 = 75 whereas actual = ??

S&P forecast is pretty inaccurate isn't it? Out by 48% for 2008 and 2009. Should we use the same basis, then Actual will most likely become 39.

Giving the PE of say 12, S&P 500 will be around 468 points. Gary Shilling gave it 600 points. Anyway, the herd continue to believe forecast by the fundamentalist analysts.

There are in for another SUPRISE. Then again, earnings leads the market theory is another fallacy although earnings is important, but it has been proven it does not lead the markets, it is the social mood that leads the market.

No comments:

Post a Comment