Wednesday, April 29, 2009

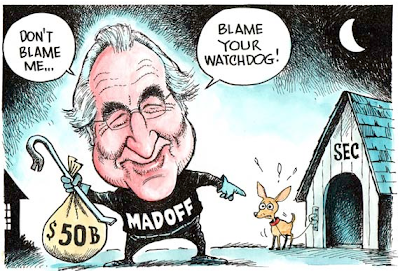

SOS Ponzi Scheme

Tuesday, April 28, 2009

SOS Printing Money

Sunday, April 26, 2009

SOS Banking Profits

S&P500 610 689 791 744 570

S&P FI 189 197 227 157 (155)

% 31% 29% 29% 21% n/a

S&P Financial Index (FI) mainly consist of financial casinos like BOA, Citigroup, Goldman, JP Morgan, Morgan Stanley, Lehman, UBS, and AIG (contribute about 50% of S&P Financial Index)

The major investment banks in US is geared more than 30 times because of derivatives, such as CDO, MBS, CLO, CDS, Liar Loans (mortgage, credit card, student loans). These are "non real economy" profits. It is "phony profits", cannot be sustained. It arises from "fractional reserve system" i.e. one dollar capital can provide up to 10 dollar loan (which is assets to the bank). For investment banks, its gearing can be as high as more than 30 times its shareholders' fund.

- The profits will be evaporated (hence 30% of the earnings will be wiped out);

- The bad debts arising from the bubble assets will further deteriorate and cause the banking system unable to provide new credits;

- The bailouts, USD700 billions merely slowdown the bad debts (CDS itself is about USD5.5 trillion, Mortage loan is about USD20 trillion, US stocks has loss about USD10.5 trillion in market value);

- Real economy is unable to get new credit to grow, hence, profits will come down

- Unemployment made the consumer unable to buy further, hence, bring down the real economy, because US the consumer contribute 70% of the GDP, i.e. about USD9.5 trillion.

So, in short, the economy of USA for the last many years is unsustainable. It created a property bubble, stocks bubble, commodities bubble, consumer loan bubble, banking bubble, and real economy bubble. Most resources (capital and human resources) went to the phony industries like banking, housing, equities, capital goods like cars etc.

Now, US and UK and Europe are paying for their "Ponzi Scheme."

Monday, April 20, 2009

SOS Bank of International Settlement

“The prime value, which also seems to demarcate the inner club from the rest of the BIS members, is the firm belief that central banks should act independently of their home governments. . . . A second and closely related belief of the inner club is that politicians should not be trusted to decide the fate of the international monetary system.”

In 1974, the Basel Committee on Banking Supervision was created by the central bank Governors of the Group of Ten nations (now expanded to twenty). The BIS provides the twelve-member Secretariat for the Committee. The Committee, in turn, sets the rules for banking globally, including capital requirements and reserve controls. In a 2003 article titled “The Bank for International Settlements Calls for Global Currency,” Joan Veon wrote:

“The BIS is where all of the world’s central banks meet to analyze the global economy and determine what course of action they will take next to put more money in their pockets, since they control the amount of money in circulation and how much interest they are going to charge governments and banks for borrowing from them. . . .

“When you understand that the BIS pulls the strings of the world’s monetary system, you then understand that they have the ability to create a financial boom or bust in a country. If that country is not doing what the ney lenders want, then all they have to do is sell its currency.”5

South Korean Experience

Similar complaints have come from Korea. An article in the December 12, 2008 Korea Times titled “BIS Calls Trigger Vicious Cycle” described how Korean entrepreneurs with good collateral cannot get operational loans from Korean banks, at a time when the economic downturn requires increased investment and easier credit:

“‘The Bank of Korea has provided more than 35 trillion won to banks since September when the global financial crisis went full throttle,’ said a Seoul analyst, who declined to be named. ‘But the effect is not seen at all with the banks keeping the liquidity in their safes. They simply don’t lend and one of the biggest reasons is to keep the BIS ratio high enough to survive,’ he said. . . .

“Chang Ha-joon, an economics professor at Cambridge University, concurs with the analyst. ‘What banks do for their own interests, or to improve the BIS ratio, is against the interests of the whole society. This is a bad idea,’ Chang said in a recent telephone interview with Korea Times.”

Asian experience

In a May 2002 article in The Asia Times titled “Global Economy: The BIS vs. National Banks,” economist Henry C K Liu observed that the Basel Accords have forced national banking systems “to march to the same tune, designed to serve the needs of highly sophisticated global financial markets, regardless of the developmental needs of their national economies.” He wrote:

“[N]ational banking systems are suddenly thrown into the rigid arms of the Basel Capital Accord sponsored by the Bank of International Settlement (BIS), or to face the penalty of usurious risk premium in securing international interbank loans. . . . National policies suddenly are subjected to profit incentives of private financial institutions, all members of a hierarchical system controlled and directed from the money center banks in New York. The result is to force national banking systems to privatize . . . .

“BIS regulations serve only the single purpose of strengthening the international private banking system, even at the peril of national economies. . . . The IMF and the international banks regulated by the BIS are a team: the international banks lend recklessly to borrowers in emerging economies to create a foreign currency debt crisis, the IMF arrives as a carrier of monetary virus in the name of sound monetary policy, then the international banks come as vulture investors in the name of financial rescue to acquire national banks deemed capital inadequate and insolvent by the BIS.”

Ironically, noted Liu, developing countries with their own natural resources did not actually need the foreign investment that trapped them in debt to outsiders:

“Applying the State Theory of Money [which assumes that a sovereign nation has the power to issue its own money], any government can fund with its own currency all its domestic developmental needs to maintain full employment without inflation.”

Saturday, April 18, 2009

SOS Denial

Wednesday, April 15, 2009

SOS Economics

PAT-repayment of loan/capital = real return on equity

Tuesday, April 14, 2009

SOS Save Gold

The above show gold is the most stable currency vs other fiat money like USD, Sterling or Euro.

The above show gold is the most stable currency vs other fiat money like USD, Sterling or Euro.You can buy the same amount of crude oil with the same oz of gold, whereas for the fiat money, all depreciated against crude oil over the years.

In short, instead of saving money/currency, save GOLD instead, it will store the value of money.

However, please bear in mind that physical gold prices is different from the paper gold prices (traded in an exchange). Meanwhile, gold price may consolidate due to the recent announcement by IMF to sell gold to raise money to help the countries in bad shape.

SOS Multiple Choice

Monday, April 13, 2009

SOS Recessions

Recession is like a draught, it is part of ecology cycle. It comes and it goes. But a man made deep recession is called a depression, a prolong draught, lots of living beings died. The Wall St. has taken over the Main St., and the Main St has to pay for the Wall St. sins. So far, there is no indepth investigations into the crisis, and the murder is cover up, and the murderers are free. None were punish, infact non performers are promoted into the Administration to cover up their very act that destroy the economy. Well, the Americans are looted under their very nose as they can do nothing about it. Pity them, called themselves a civilize society.

Recession is like a draught, it is part of ecology cycle. It comes and it goes. But a man made deep recession is called a depression, a prolong draught, lots of living beings died. The Wall St. has taken over the Main St., and the Main St has to pay for the Wall St. sins. So far, there is no indepth investigations into the crisis, and the murder is cover up, and the murderers are free. None were punish, infact non performers are promoted into the Administration to cover up their very act that destroy the economy. Well, the Americans are looted under their very nose as they can do nothing about it. Pity them, called themselves a civilize society.French's president during the G20 assembly says that the money printing and bailouts by US is "a way to hell." I couldn't agree more. G20 is now given the IMF to print more "magic money" from the Special Drawing Rights, up to a tune of USD1.1 trillion, bravo, export of inflation to the world.

SOS World Trade Shrinks

Sunday, April 12, 2009

SOS Inflation Stocks

- Yamana Gold Inc (AUY) - Gold producer

- Zhongpin Inc (HOGS) - Food (meat) producer

- Eldorado Gold Corp (EGO) - Gold producer

- Royal Gold Inc (RGLD)

- Gold Corp (GG)

- Potash Corp (POT) - Fertilizer producer

- Silver Wheaton (SLW)

- Barrick Gold (ABX)

- Newmont Mining (NEM)

Saturday, April 11, 2009

SOS Trendsetter

It must satisfy the 25% spender on the globe for things/services they NEED and WANT via innovation & quality. Some of the areas are:

- Energy (alternative energy)

- Health (SARs, clean food, water - 70billion biz)

- Education (Distance learning with China and India)

Friday, April 10, 2009

SOS Mind, Body & Soul

Thursday, April 9, 2009

SOS Delusion

Fact : world GDP is about USD55 trillion

Fact: world derivatives is about USD650 trillion

Fact: credit default swap is about USD5.5trillion

Fact: US unemployment is 8.2% or about 5 million

Fact: USD debt over GDP in 2008 is 358% (GDP is about USD13.5trillion)

Myth: Institutions (Fannie, Freddie, AIG, Citigroup) to big to fall

Myth: Printing Money will resolve the crisis, look at Argentina and Japan (consequences is hyperinflation)

SOS Argentina

Wednesday, April 8, 2009

SOS New World Currency

G-20 approved creation of new world currency, given the authority to IMF to issue up to USD750 billion, via the SDR, special depository rights.

Who control IMF, the few influencial central bankers, the most dominates one is the UK's Bank of England and US's Federal Reserve (privately owned by group of elites).

Well, normally this is how the money is used, it goes to the countries that needs help, say the Eastern Europe, it goes in, with conditions, and it came out back to the lenders from Western Europe, whereby the lenders, again is owned by the elites.

AIG

The Federal Reserve injected about USD180 billion into AIG, and immediately, AIG pay to the counter party, namely, Golman Sach, Deutch Bank, Society General, UBS [35%]. Remember UBS was fined by the American for secrecy accounts up to USD750 million, the following day UBS received from AIG about USD5 billion as the counter party. Not bad, UBS got a cool net cash of USD4.25 billion.

Car Industry and Financial Industry

Fed bailout most major banks without much condition, on ground of too big to fail, but hesitated and only given GM a couple of billion, with lots of conditions, including plans on how to restructure and recover, while the bankers got away free. If the Fed gave say, USD10 billion to GM, it may have save at least 1 million of employees in the motor industry. However, without hesitation, Fed bailout the financial institutions, not even a plan is needed, just the justification of to big to fail or systematic risk involved.

MyView

- Why are the elites bankers being bailout without much conditions or plan while the motor industry will not be spared eventually?

- Why does G20 create new currency to a tune of USD750 billion, used as quantitative easing?

- Why does big chunck of money injected into AIG goes to European banks?

To know more, you have to complete the puzzle by yourself, well, the following may help [take it with a pinch of salt]

- Max Keiser

- Alex Jones

- Webster Tarpley

- Gerald Celente

- Project Camelot

- David Icke

- George Green

- Carroll Quigley (Tragedy and Hope)

- Matthias Chang

- Not me.

SOS Common Sense

- Can printing money resolve the recession?

- Can printing money and use the money to buy toxic assets creates economic values?

- Doesn't it has any consequences?

- If it is that simple, why did Japan, who did print a lot of money (public debt increased drastically over the lost decade) their share market is still the same as the 1980s?

- If Japan, having such a huge surplus and net export, cannot get out of the recession, what makes us think USA or Europe, who is doing the same, can get out of recession over the next few years?

- Have we not forgotten, it was easy credit, overgearing and consumption that cause this crisis, and why are we doing the same thing to resolve it, printing more money?

- Is Argentina out of the woods? They printed lots of money during their crisis, and there was one year, the inflation rate is more than 10,000%, what can we said about that?

- US problem involved over gearing of the Government, the Corporate and the Household owners and also something called Derivatives (elites bankers casino business) can be resolve by just printing money?

- Someone has to pay for the consequences for printing of money isn't it? The Americans, of course, what they are doing now is privatising profits (elites bankers) and socialising losses (from the average Americans). Over time, the American dollar will depreciate, only then, a recovery will be in sight, together with high inflation.

- We need to look at the situation using common sense (throw away the economic books), any action that does not bring economic value, in the long run, the standard of living will deteriorate.

Tuesday, April 7, 2009

SOS CDS

AIG sold protection to banks on pools of risky mortgages and other assets in the $55 trillion credit derivatives market…

AIG sold protection to banks on pools of risky mortgages and other assets in the $55 trillion credit derivatives market…So folks, what do you suppose the odds are that the Federal Reserve’s proxy bank – J.P. Morgan, the most dominant player in this space - had more than a few trades on its books where AIG was their counterparty?

Sunday, April 5, 2009

SOS Underwater!

- Money printed by Central Banks/Federal Reserve

- Money printed by private banks (fractional system and investment banks) [20 years ago there were no derivatives, now it is about USD600 trillion - world derivatives]

- Debt [the amount of debt created today is far larger than the economy, US federal debt is about USD10 trillion, consumer debt is about USD9 trillion and corporate debt is about USD9 trillion)

- Privatise profits and socialise losses

- Gold

- Commodities

- Properties

There is a very high risk of World War 3!

Food price will shot up the roof

Dear all,

Get prepared for the tsunami. It is no longer an isolated problem like the Asian Crisis, Argentina crisis (cause Falkland Island wars), Brazil, Mexico (tequila crisis), both US and Europe makes out of two third of world GDP, and it will collapse due to over debt.

Hyper inflation from US and Europe will be exported around the world.

Adrian Salbuchin speaks from his own experience in Argentina, and recommended all to be prepared, and study the Argentina crisis in 1975, 1982 and 2004 whereby hyper inflation went above 10,000%.

Saturday, April 4, 2009

SOS Investor

- Be sceptical

- Be curious

- Be persistent

Other characteristics

- independent

- do homework

- dont follow others

- always find out and research

- over time, experience will allow you to make good judgements

SOS Mark to Market

Will it solve the problem if we change to mark to model instead of using mark to Market?

I have never heard of the underlying fundamental of an asset will improve just because we change the accounting treatment. The asset does not have much underlying value not because it is illiquid, it is because the asset does not carry such value. The new accounting treatment may only defer the problem, but will not solve it at all.

It is like change the accounting treatment from writing of interest expenses immediately instead of amortising it over the concession period of the toll. The fact is that one may improve the profit and loss account, and perhaps the rating, the underlying fact is that the interest is already being paid. Whether we write off immediately or over 10 years, the said cash flow is already out of the company and never gonna come back, no matter how we treat it.

Friday, April 3, 2009

SOS Run!

G-20 equity rebound is a "dead cat bounce"

Don't get suck into the financial tsunami!

Unless you are in ETFs on Commodities, or shares that in commodity business, (energy, precious metals, agriculture) don't get suck into equity.

Keep cash or put some in Gold.

Build up your own Central Banks, like what Marc Faber said, diversified into other asset classes.

Thursday, April 2, 2009

Wednesday, April 1, 2009

SOS Deception

- Webster Tarpley

- Alex Jones

- Deception of Obama

SOS Investors

- sceptic - don't believe everything you here on the media, do your own homework, form your own opinion, etc

- curious - figure out what people going to do, have your homework and think far ahead

- persistent - many will fail along the way, figure out, and come back

He also said 80% of the professional investors do worst than the market average. He also said, don't speculate, or invest base on insider information

MyView

- A good investor has to have an independent "thinking process"

- Do his or her homework

- Willing to go against the crowd, because we know 80% of the crowd will not get rich, only less than 20% will make it