Henry Dent says.........

The economy appears to recover from the subprime crisis and minor recession by mid-2009 — "the calm before the real storm."

Stock prices start to crash again between mid- and late 2009 into late 2010, and likely finally bottom around mid-2012 — between Dow 3,800 and 7,200.

The economy enters a deeper depression between mid-2010 and early 2011, likely extending off and on into late 2012 or mid-2013.

Asian markets may bottom by late 2010, along with health care, and be the first great buy opportunities in stocks.

Gold and precious metals will appear to be a hedge at first, but will ultimately collapse as well after mid- to late 2010.

A first major stock rally, likely between mid-2012 and mid-2017,will be followed by a final setback around late 2019/early 2020.

The next broad-based global bull market will be from 2020-2023 into 2035-2036

Saturday, June 27, 2009

Wednesday, June 24, 2009

SOS Deflationary Depression

What is deflation?

The question what is deflation is easy to answer. But, defining the word is different than understanding the threat – because widespread public ignorance of the effects of deflation and the deflationary spiral makes deflation a menacing risk now more than ever.

Define Deflation and InflationWebster's says, "Inflation is an increase in the volume of money and credit relative to available goods," and "Deflation is a contraction in the volume of money and credit relative to available goods." To understand inflation and deflation, we must understand money and credit.

Define Money and CreditMoney is a socially accepted medium of exchange, value storage and final payment. A specified amount of that medium also serves as a unit of account.

According to its two financial definitions, credit may be summarized as a right to access money. Credit can be held by the owner of the money, in the form of a warehouse receipt for a money deposit, which today is a checking account at a bank. Credit can also be transferred by the owner or by the owner's custodial institution to a borrower in exchange for a fee or fees – called interest – as specified in a repayment contract called a bond, note, bill or just plain IOU, which is debt. In today's economy, most credit is lent, so people often use the terms "credit" and "debt" interchangeably, as money lent by one entity is simultaneously money borrowed by another.

After the deflationary depression......................hyperinflation...... that is when the commodities prices fly............... The end.

Friday, June 19, 2009

SOS Elliot Wave

Dear Readers

It is a worthwhile for readers to read Elliot Wave Theorist, Robert Prechter

http://www.elliotwave.com/ and his book Conquer the Crash (updated 2009)

He said, we are at Wave V, started since 1930 Wave I. So, we will deflate first (due to credit inflation over the last 30 yrs) and then hyper inflation on USD currency (also can be said destruction of money and credit - which is inflation)

It is a worthwhile for readers to read Elliot Wave Theorist, Robert Prechter

http://www.elliotwave.com/ and his book Conquer the Crash (updated 2009)

He said, we are at Wave V, started since 1930 Wave I. So, we will deflate first (due to credit inflation over the last 30 yrs) and then hyper inflation on USD currency (also can be said destruction of money and credit - which is inflation)

Tuesday, June 16, 2009

SOS Top 10 Military Spender

SOS Stocks

Green Shoots turns out to be Yellow Weeds

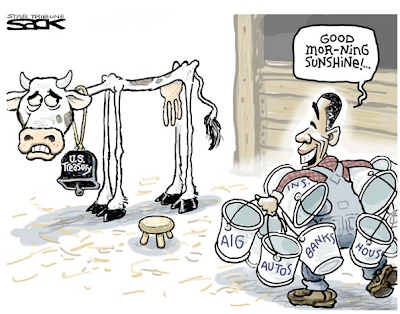

Stimulus Plan/Bailout/Quatitative Easing

When you put good money in bad investment, you will actually cause misallocation of resources, and also cause inflation especially when you print your own money

When one money supply increases and increase consumption activity, it will fizzle out, as it does not help economic growth, but temporarily created a phony economy of consumption. If you increase your money supply and invest into a productive venture, it creat new jobs, makes money, increase taxes, economy will not inflate, if you increase money supply on an unproductive ventures, the additional money in circulation will cause hyper inflation in the long term if the supply is huge, vs your size of economy like USA.

Monday, June 15, 2009

Saturday, June 13, 2009

SOS Real Economy & Phony Economy

Real vs Phony Economy

Phony Economy

- Derivatives bubble

- Mortgage bubble

- Equity bubble

- Debt bubble

- Bailout bubble

Real Economy

- Production of goods

- Services

- Infrastructure building

- Commodities productions

- Natural resources productions

- Food and beverage productions

- Energy productions

Inflation

- Inflation will be high when government print lots of money and put into bad investment (bailouts)

- Marc Faber say 2-3 yrs time, not supprise if US inflation is up to 12 to 15% and hyper inflation in the longer run

SOS Democracy vs Socialist

USA vs Russia

USA vs RussiaPersuasion vs Draconian

Media vs Authority

It is very hard to have an independent thinking when you are surrounded by elite control media via internet, tvs, dvd, papers, magazine, journals, books etc. It is getting difficult to differentiate between truth and myth.

It is time, to use our most underused assets - COMMON SENSE

Who is Barrack Hussein Obama 3 yrs ago, and what is he now.

If you are the CEO of USA, who do y0u answer to?

Who do you get advice from?

Who is your back up?

Well, thinking is always hard, especially it depends on the "input we receive daily."

Start thinking, or someone else will think for you.

Thursday, June 11, 2009

SOS 2009 Too Big To Fail

Tax revolts in California! By Gerald Celente, Sales tax raised from 5 to 9%, raised income tax, beverage tax, national sales tax.

The US Government thought they can solve all problems, bailout banks, insurance co, general motors etc. The bailout bubbles!

Forget your economic textbooks, this is real, deflation, inflation, stagflation, depression, recession, reflation, hyperinflation, devaluation, you name it, you have it. It is the combination of all.

Saturday, June 6, 2009

Friday, June 5, 2009

Wednesday, June 3, 2009

SOS Out of Recession?

What is said in May 2009.

Li Ka Shing said lately that be cautious about the share markets, i.e. it may be too high to invest.

Jim Rogers said lately, a correction is due.

Tim Woods said this is a "false rally," refering it as a sucker rally.

Well good luck to those who think that we are out of the woods. Or is it the same crowd that misses out on the last one?

Just ask ourselves these few questions:

- Are US, UK or Europe out of the web of debt yet?

- Are they any new major policy implemented to deter derivatives?

- Did US stopped printing money?

- Is China recovery sustainable and able to replace US and Europe GDPs?

Well, for equity players, be extraordinarily careful. It is like tsunami, when everyone thought it was over when the first wave recides, it is actually the second one is the most deadly one.

Subscribe to:

Comments (Atom)